What is Open Banking?

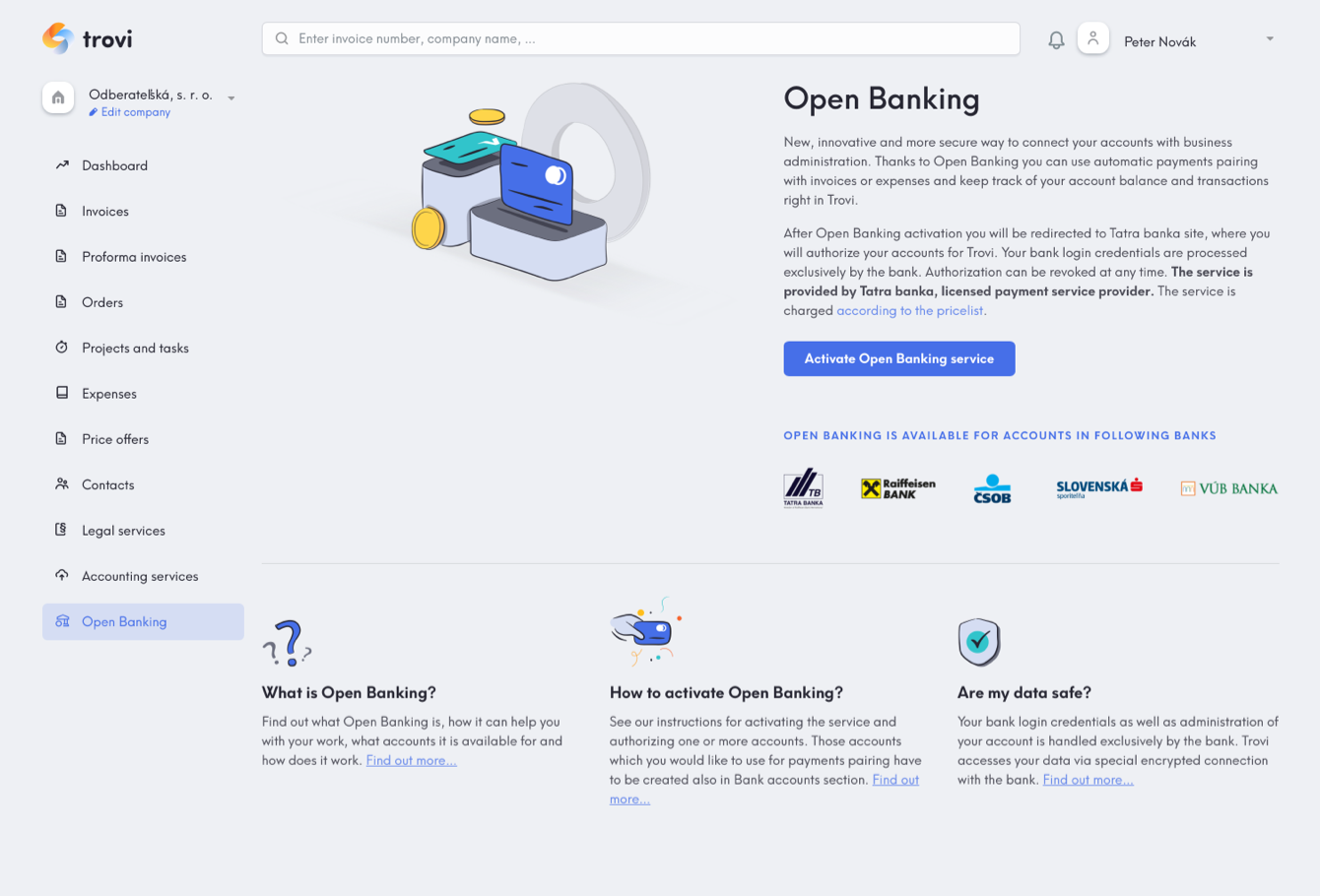

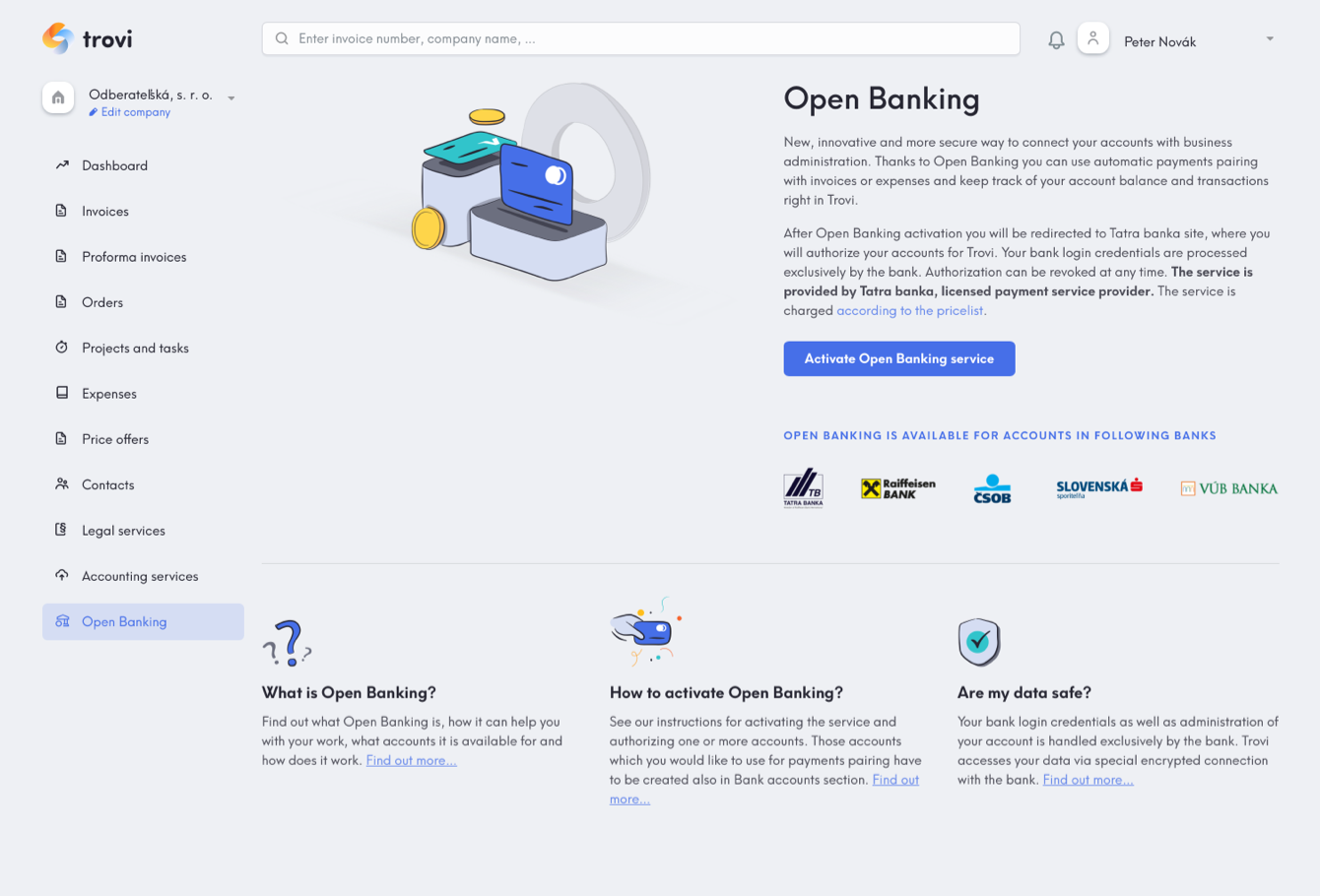

Open Banking is new, innovative and more secure way to connect your accounts with business administration that you have in Trovi. Thanks to Open Banking you can use automatic payments pairing with invoices or expenses and keep track of your account balance and transactions right in Trovi. We are already working on new features, which will safe you some time, effort and will bring you some new benefits.

The service is provided by Tatra banka, licensed payment service provider.

The service is charged according to the price list.

Open Banking is currently available for accounts in following banks:

The service is provided by Tatra banka, licensed payment service provider.

The service is charged according to the price list.

Open Banking is currently available for accounts in following banks:

Open Banking - are my data safe?

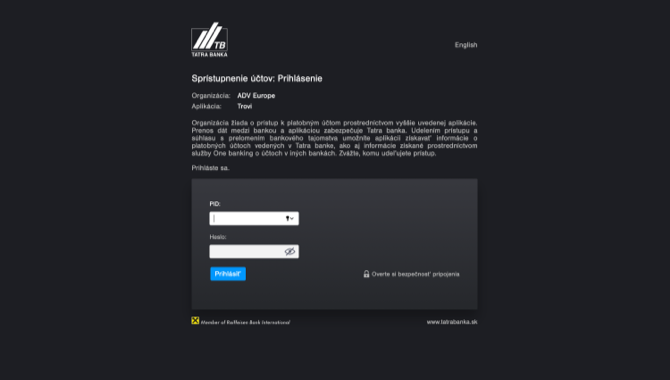

Open Banking service is provided by Tatra banka, licensed payment service provider. Trovi is connected to this service by a secured and audited API, which combines the technical and security requirements of Tatra banka and the National Bank of Slovakia. After Open Banking activation you will be redirected to Tatra banka site, where you will authorize your accounts for Trovi. Your bank login credentials are processed exclusively by the bank. Authorization can be revoked at any time.

How to activate Open Banking?

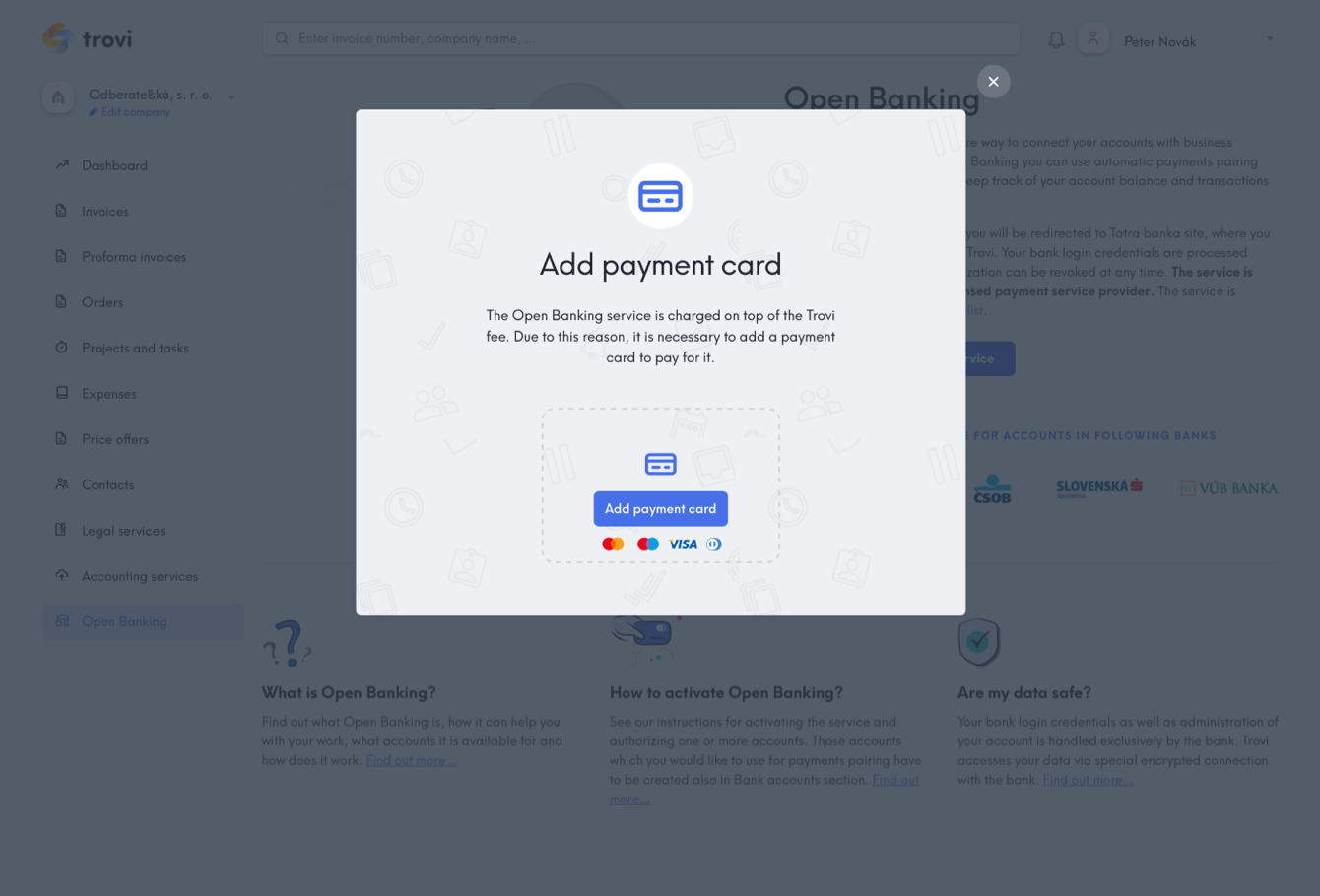

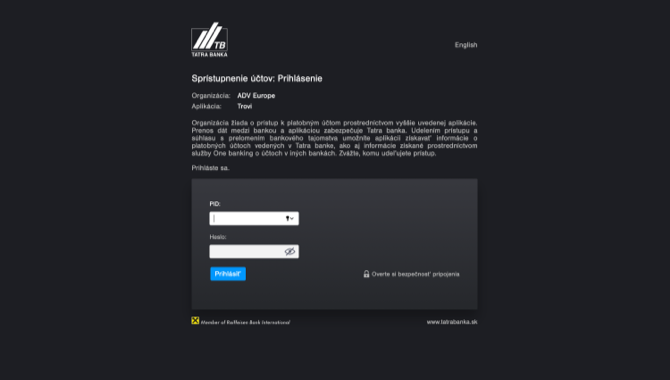

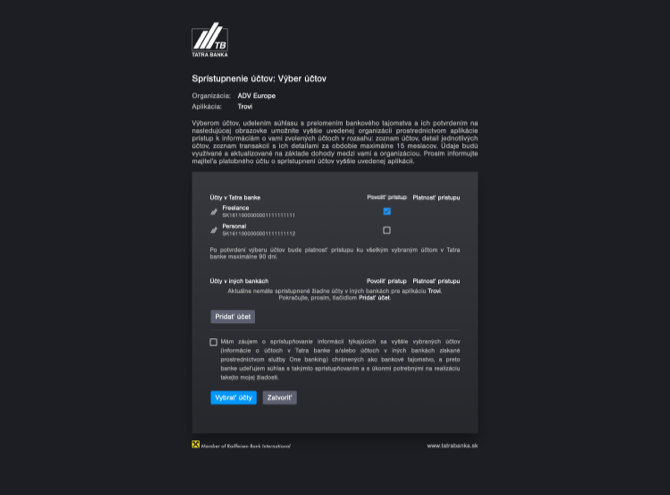

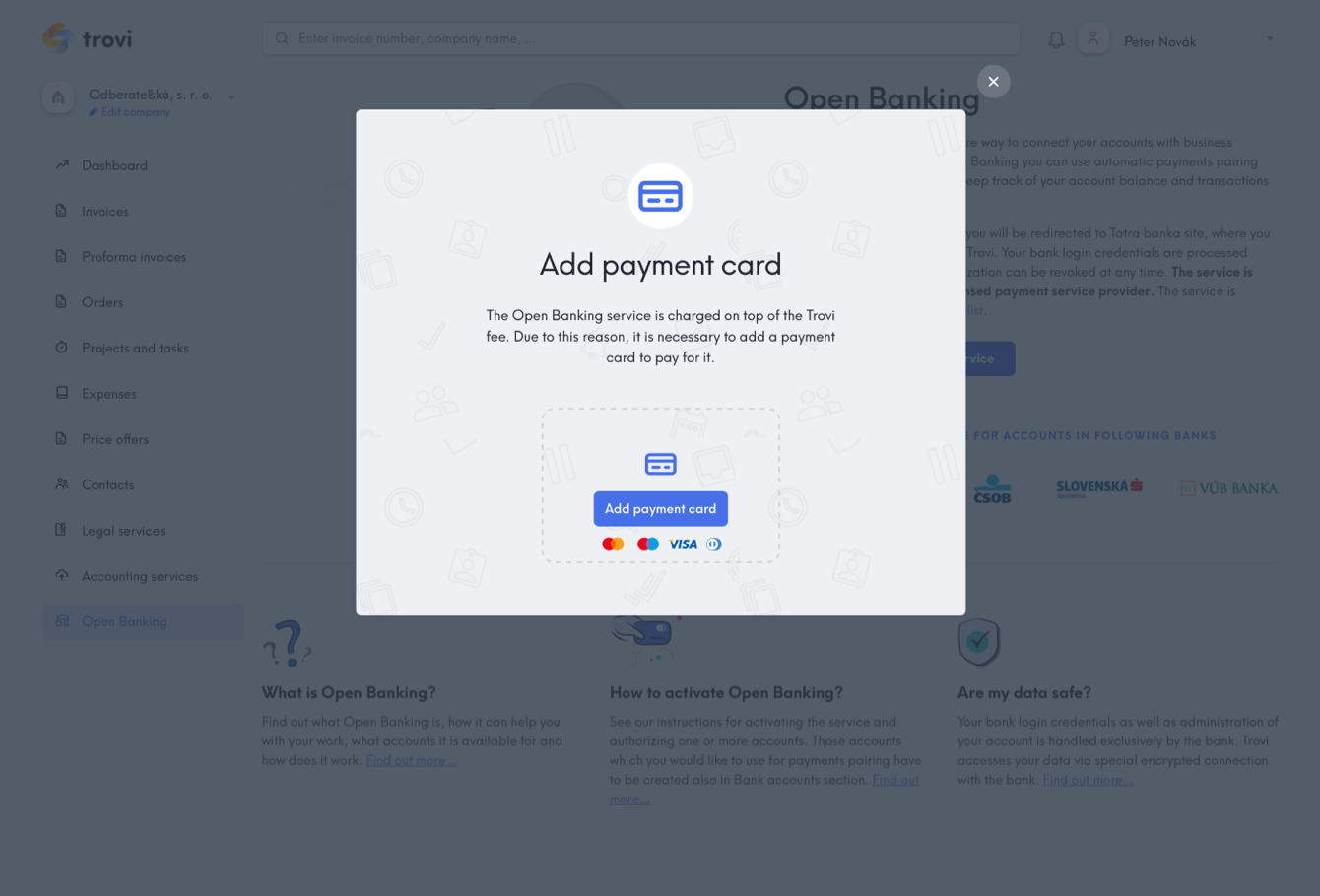

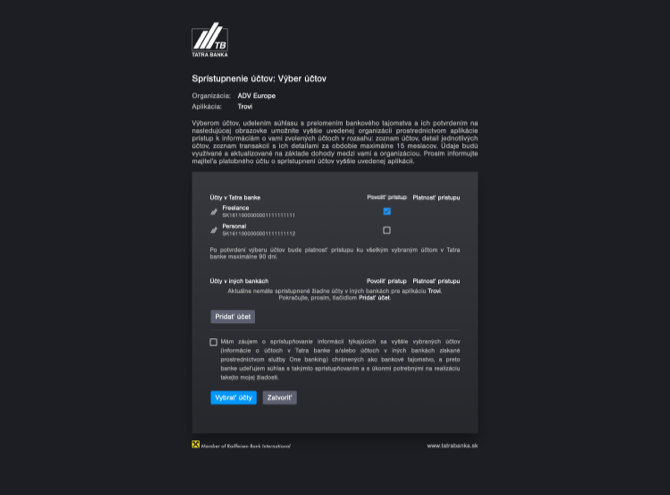

After you log in to the Trovi, you will find Open Banking on the bottom of left menu. There you will find all basic information about the service, which we recommend you to read. Fees for use of the Open Banking service are always generated for the entire calendar month by the bank. Due to this reason, a full monthly fee will be charged for activation on any date. If your situation allows so, we recommend activating the service at the beginning of the month to get the most out of the fee. Before activating the service, it is also necessary to add a payment card, which will be used for payments for the Open Banking service. You can add a card in the settings of the service or go straight to the activation, where Trovi will automatically notify you and allow you to add the card. After clicking Activate Open Banking service button, you will be redirected to a bank site, where you will authorize your accounts for Trovi. On the site of the bank it is necessary to log in with your internet/mobile banking login credentials. Your bank login credentials are processed exclusively by the bank. You will then be redirected to a screen where you will be able to choose which of your accounts you want to authorize and add to the Trovi. If you wish to add accounts from other available banks, you will be redirected to the site of a particular bank, where you will need to verify yourself with the login credentials of that particular bank. After selecting particular accounts and confirming your selection, you will be redirected back to the Trovi, where you will be able to work with your accounts. If you want to use any of the accounts for automatic payments pairing, you must also add this account/IBAN to the Bank accounts section. Each account will be authorized for 90 days, after this period it will be necessary to reauthorize each account (reauthorization can be done for all accounts at once). The length of the 90-day authorization is set for security reasons based on the requirements of Tatra banka and the National Bank of Slovakia.

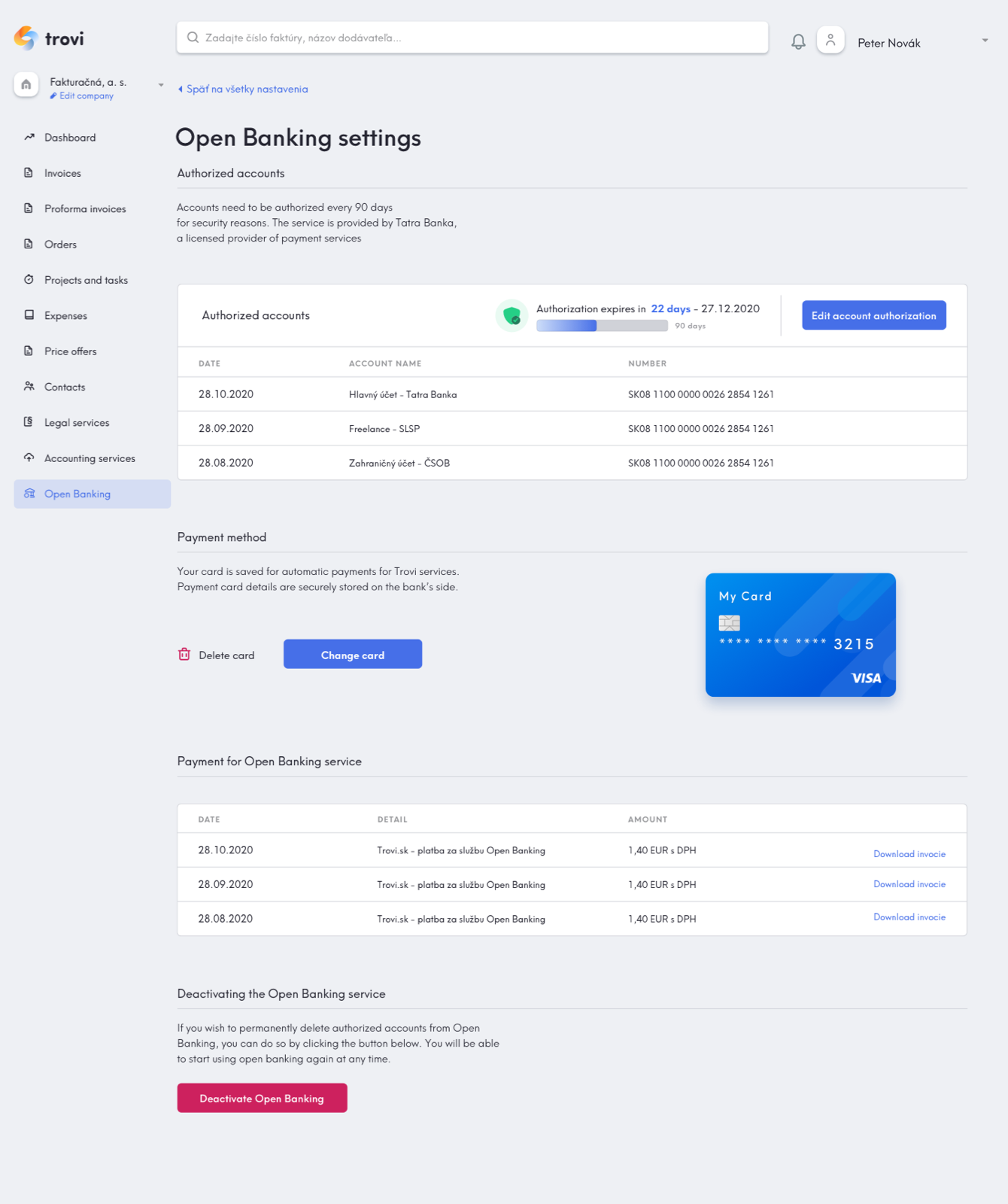

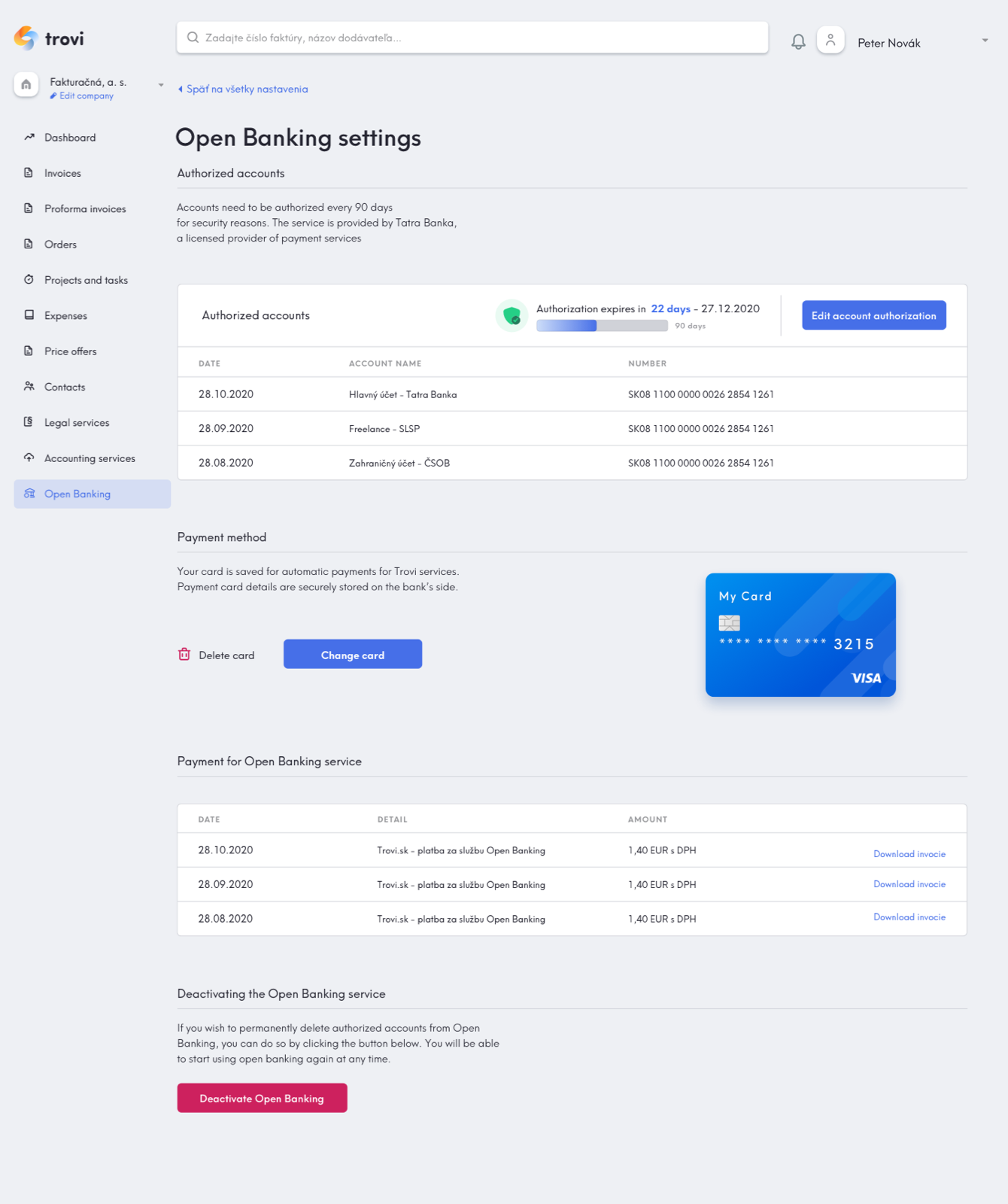

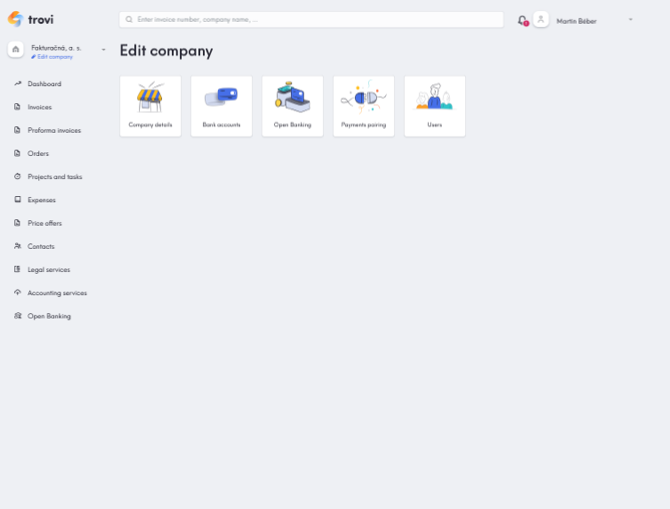

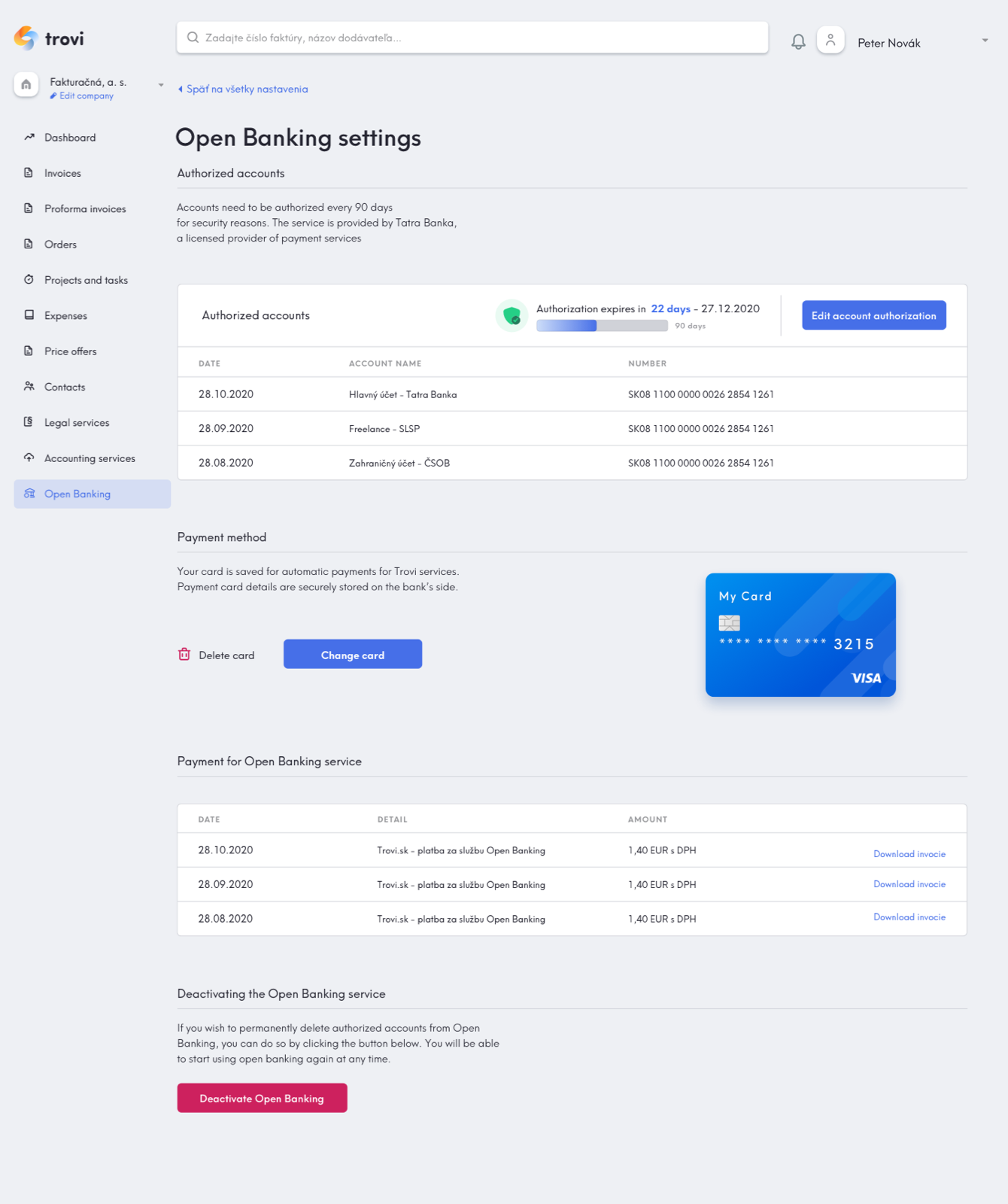

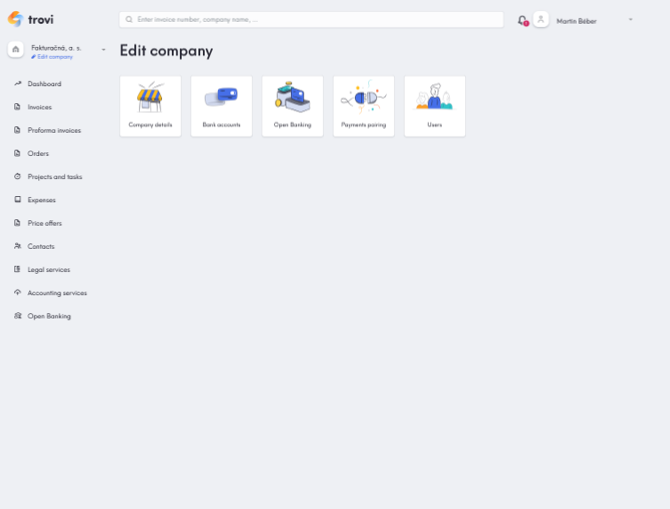

Open Banking - changing or deactivating accounts

You can change the authorization of accounts at any time.If you already have an account or accounts activated, you can add more of them at any time. You can also deauthorize any of your accounts at any time. If you wish to make any change, you can do so via the Open Banking settings, which you can access via section Edit company, or via the Open Banking settings button on the screen of the service. You make these changes exclusively on the bank's site, so you will be redirected to the bank's site after clicking the Edit accounts authorization button in the Open Banking settings. Then follow the instructions and select which accounts you want to authorize. Please note that this change only authorizes the accounts you select at this time and they will be reauthorized for another 90 days. The entire service can be deactivated by clicking the Deactivate Open Banking button in the Open Banking settings. The service will be immediately deactivated withoutobligationtoauthentication on the banksite. The Open Banking service is charged according to the price list per each account that was active in a given month, regardless the number of active days. For this reason, we recommend that you consider changing your accounts or deactivating the service at the end of the month.

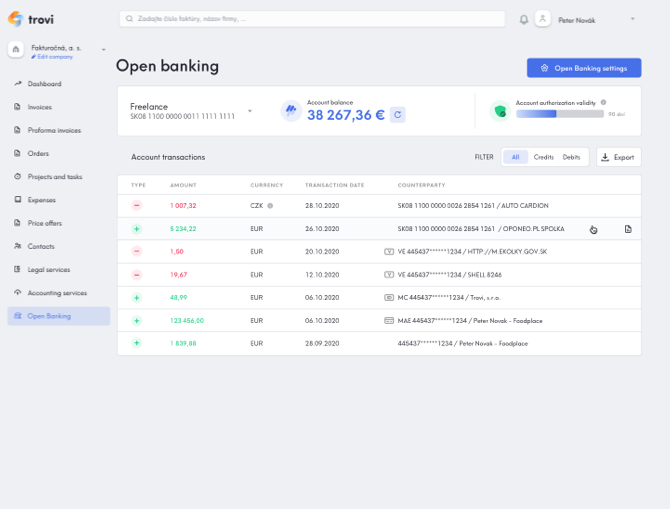

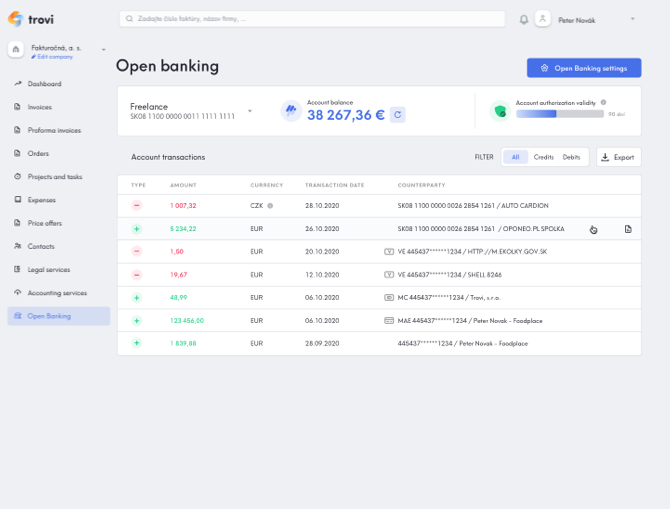

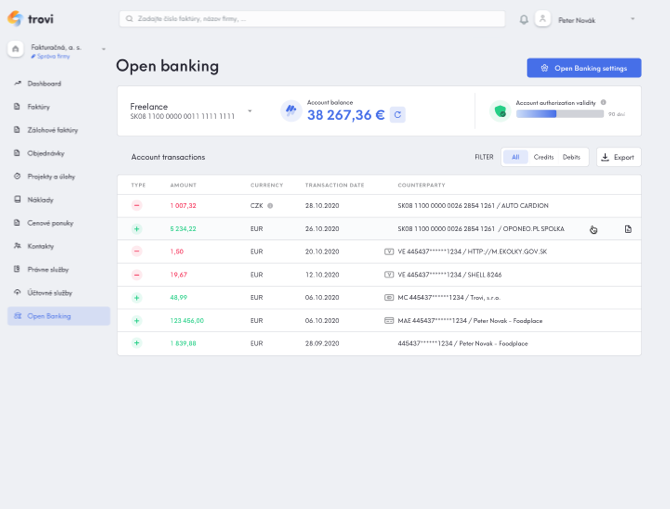

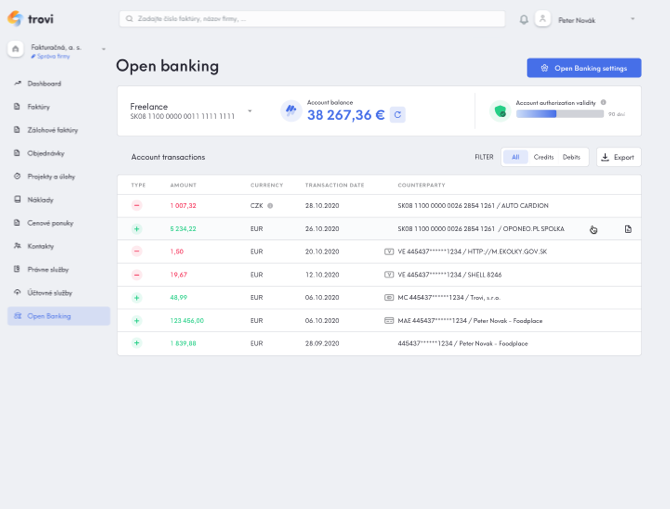

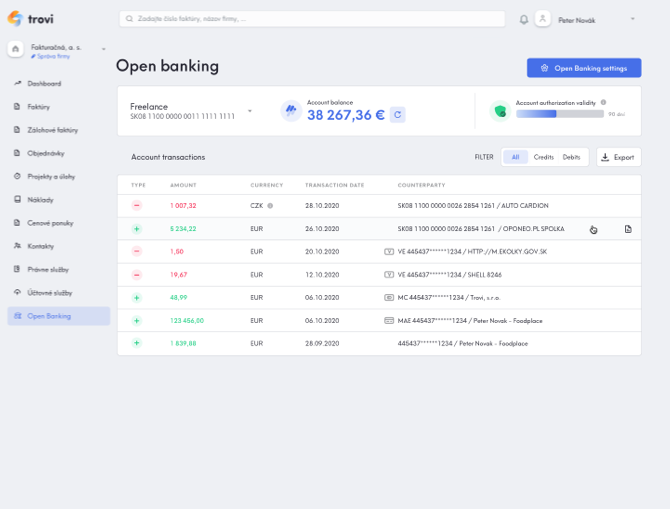

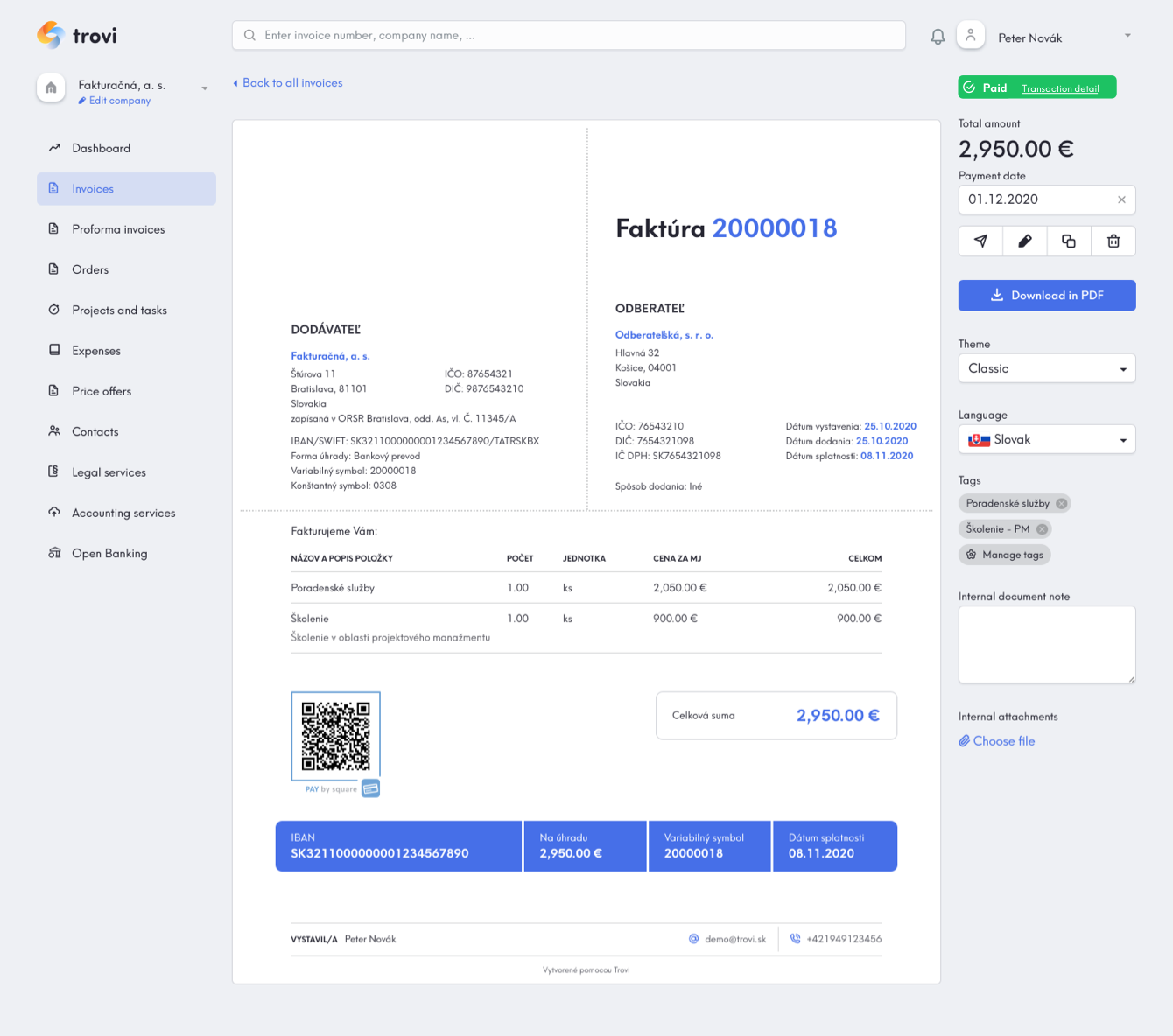

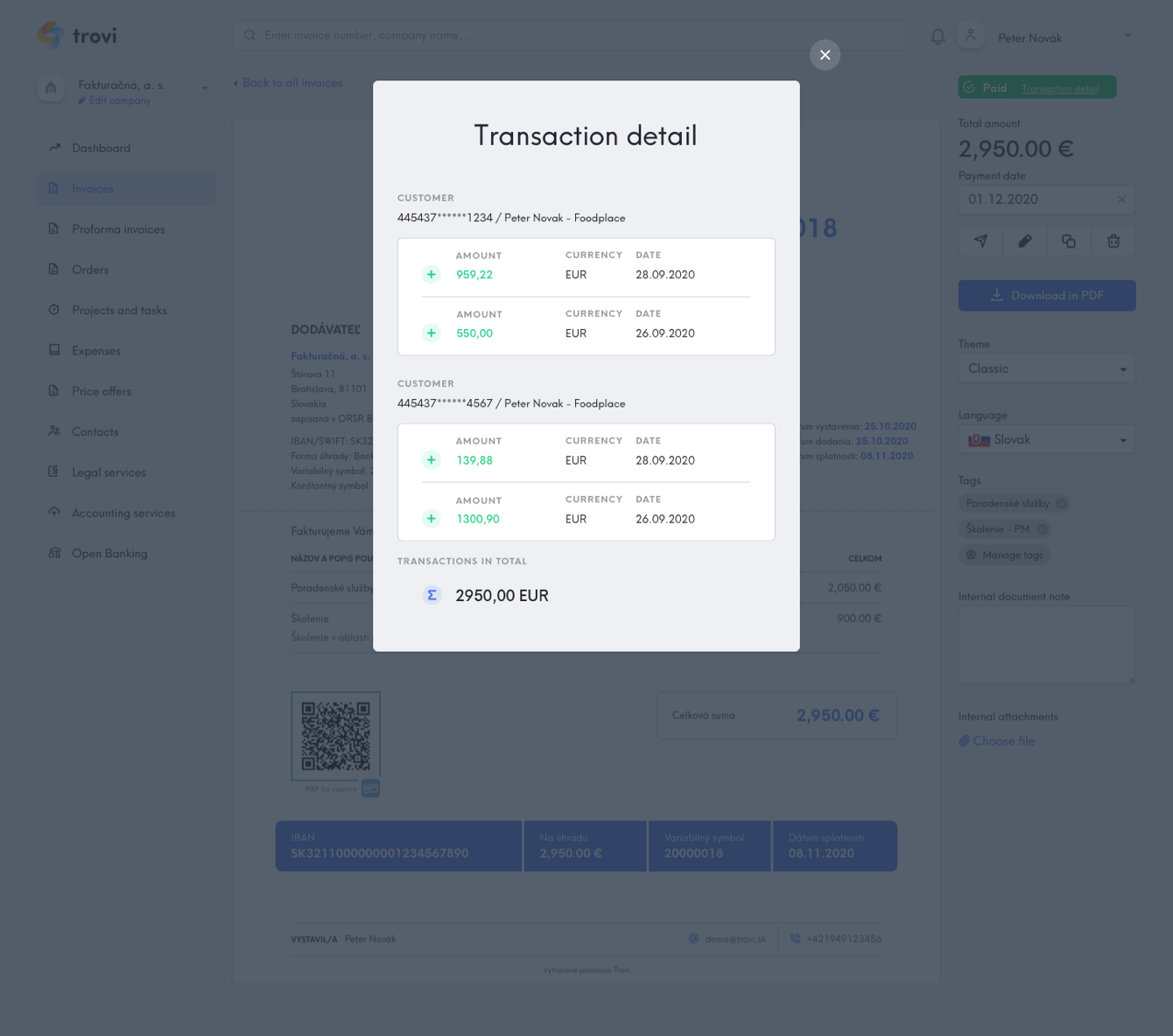

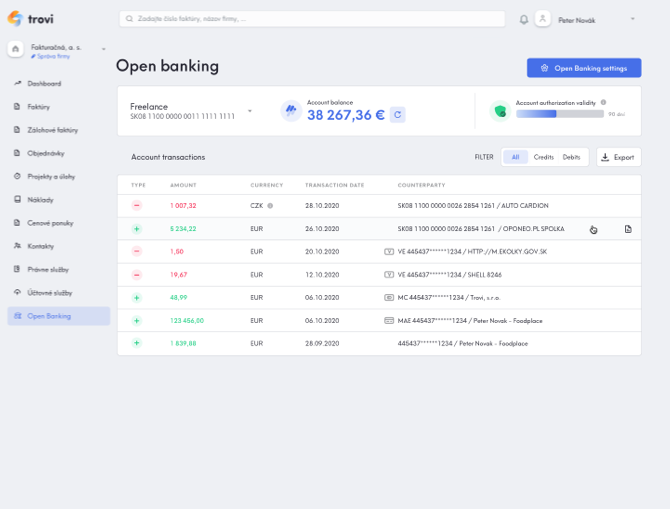

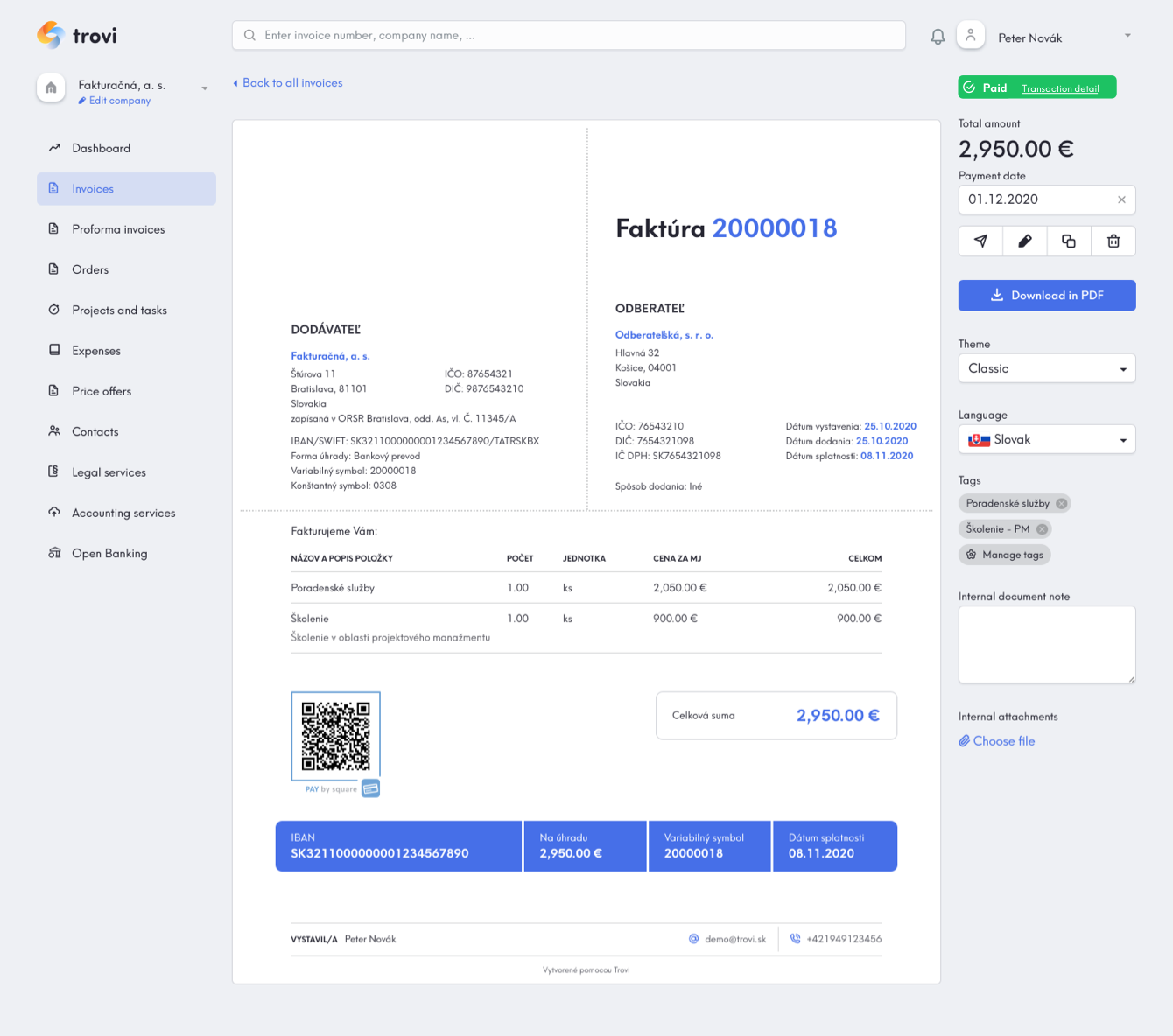

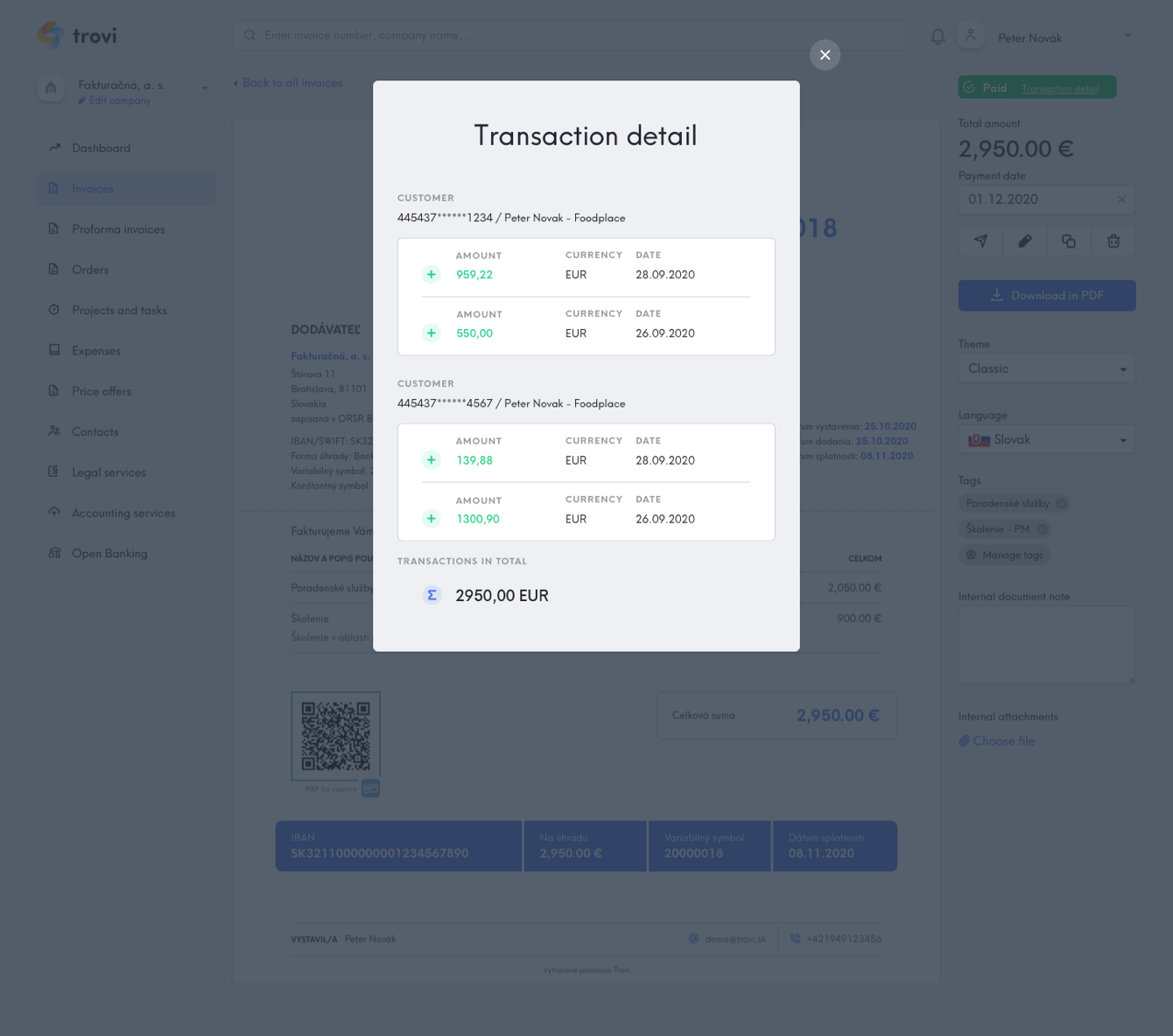

Open Banking - payments pairing and work with transactions

You can check account balance and transactions with all necessary details for each authorized account.You always have a history of 3-6 months, depending on when you have authorized the account.You can filter or export transactions for each account to xlsx. If you want to use any of the accounts for automatic payments pairing, you must also add this account/IBAN to the Bank accounts section. Subsequently, all account's transactions will be paired with invoices or expenses in Trovi. Pairing of a transaction with an invoice or expense is indicated by a distinctive icon at the end of the line in the transactions statement. On the invoice or expense detail with paired transaction, a button will appear next to the payment date, under which a detailed statement of all paired transactions could be found, together with their sum. We will also notify you about the pairing of the payment with the invoice or expense on the Dashboard and in the All events section.

Open Banking - price and payment for the service

The service is charged according to the price list. Payment for the service is possible only with a payment card, which needs to be added before service activation. The payment card administration can be found in the Open Banking settings, together with a list of all payments for this service and invoices, which can be downloaded anytime (even after service deactivation). These invoices for the service are also automatically uploaded to the Expenses section (if you have this setting). The service is paid per month in advance and it is charged for each account that was authorized. After activation and the first payment, the monthly fee is paid automatically, of course, unless you deactivate the service. Automatic payments are performed several days before the end of the month and if payment fails for any reason, we will try it again twice more. Fees for use of the Open Banking service are always generated for the entire calendar month by the bank. Due to this reason, a full monthly fee will be charged for activation on any date. If your situation allows so, we recommend activating the service at the beginning of the month to get the most out of the fee. We also recommend that you consider this setup when changing or disabling accounts. We recommend that you deactivate any account at the end of the month to get the most out of the fee.